“I graduated from Cabrini University back in 2004 with about $20,000 in student loan debt,” Jonathan Zeminski, Cabrini alumnus, said. Zeminski is a financial adviser with Wells Fargo Advisors, in Devon, Pa.

What is the current student loan debt crisis in America like?

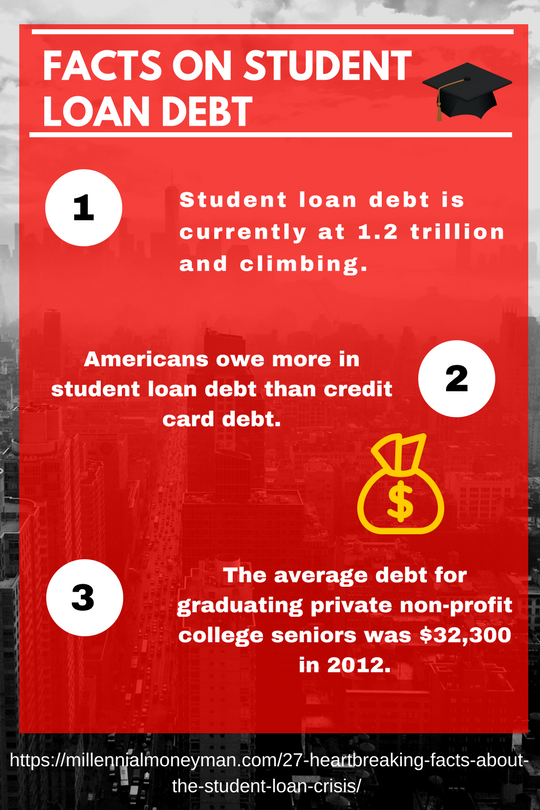

With the total student loan debt in America being over $1 trillion as of last year, there is a clear problem. That is 40 million Americans who have student loan debt, or 20 percent of the entire country. In 2013 the federal government was projected to have gained a staggering $50 billion off of student loans.

Pew Research Center reports that those with no student loan debt accumulate nine times as much wealth compared to those who have student loan debt.

How does the repayment process work ?

“Federally students would be required to start repayment usually six months after they graduate from the university or cease to be enrolled at least on a part time basis,” Betsy Gingerich, director of financial aid at Cabrini University, said.

“The standard repayment for student loans is 10 years. When you’re working with your loan servicer as you’re entering the payment process students are automatically placed in the standard 10-year repayment plan. The total amount of debt is divided into 10 years or 120 months and that equals your monthly payments,” Gingerich said.

What are the different types of loans ?

Do you have a subsidized or an unsubsidized loan? Is it a fixed or variable rate loan? Are they federal or private loans?

These are questions that students need to know.

If you have a direct subsidized loan, the government pays the interest on the loan while you are enrolled in school at least part time.

An unsubsidized loan means that the interest starts accumulating as soon as your school receives the money.

A fixed rate loan means that your loan is locked into an interest rate that will not go up or down once you take out that loan.

A variable rate loan may periodically increase your interest rates as they see fit.

What are the best ways to pay them back?

“I think the first thing that students need to do is get prepared and organized,” Zeminski said.

According to Zeminski it is best to make sure you know how many loans you have to pay back and be prepared to create a payment plan.

After he first graduated from Cabrini he held down a full time job and a part time job in order to make some extra cash. Jonathan met his wife Bernadette while they were both receiving their undergraduate education at Cabrini.

“The one thing I want students to keep in mind is that the interest clock is ticking. Even though you’re not making payments and your loans are in a deferred status you’re still accumulating interest. Ideally you want to start to pay back as aggressively as possible despite the grace period,” Zeminski said.

Dr. Donald Taylor, president of Cabrini University, also shared the story of his student loan debt, experience and repayments while married to his wife Lechia Taylor.

Taylor and his wife both received their undergraduate education in the 1980s. Combined, the couple had an estimated student loan debt of $100,000. “It took us 10 years to pay off that debt. We paid off every penny and to this day we would argue it was the best investment we ever made,” Taylor said.

Taylor worked three part time jobs as an undergrad and had to go to summer school every year trying to finish and graduate.

What are your options?

Most graduates tend to either defer their loan payments due to pursuing graduate studies, default on their loans or apply for a forbearance.

A deferment is a period during which repayment of the principal and interest of your loan is temporarily delayed. A forbearance allows you to stop making payments or reduce your monthly payments for up to 12 months.

Gingerich suggests that students who have unsubsidized loans or any type of loan that is gaining interest while the student is in school should keep up with trying to make some interest payments.

“Our graduates from Cabrini have graduated with about $7,000 less in student loan debt than our top 10 competitors,” Taylor said.

The current debt crisis is only getting worse for those who do not stay proactive with their knowledge and monthly payments of their student loans.