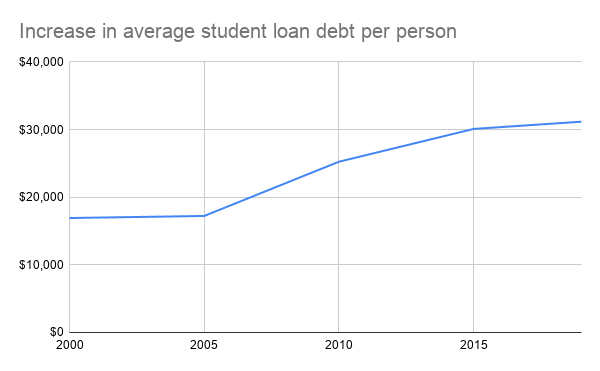

Student debt continues to climb

Recent college graduates are suffering from more student debt than in previous years, forcing them to put a hold on their lives. On top of that, tuition and fees continue to increase at both public and private institutions, a major cause of the rise in student debt.

College graduates in 2018 were proven to be in deeper debt than previous classes, with two in three college graduates borrowing money for their education.

Caitlyn Huebner, a 2018 Cabrini graduate, is working towards paying off her student loans.

“I owe roughly $60,000 in student loans. I’m very lucky to owe not a terrible amount of money compared to others…Even still, $60,000 is a lot of money,” Huebner said.

Despite taking out a student loan and a parent loan her freshman and sophomore year, Huebner worked all throughout college to be able to pay for a portion of her tuition out of pocket. Whatever wasn’t covered by her loans, she was paying with her own money.

“It was stressful and scary, for sure, paying somewhere between $15-20,000 out of pocket,” Huebner said. “But I’m very thankful I was able to do so.”

A hold on life

Now that Huebner has graduated, she feels that her student loans have affected large aspects of her life.

“My student debt has affected the larger aspects of my life [getting married and buying a house]. It’s harder to save up for these events and milestones, which, in return, continue to get pushed back,” Huebner said. “My fiancé and I have considered moving in with family or living with friends so the rent would be cheaper in addition to finding other ways to save money.”

ProgressNow found that students with an abundant amount of student loan payments were 36 percent less likely to purchase a house. The New York Times indicated that “Those with student loan debt also are less likely to have taken out car loans. They have worse credit scores. They appear to be more likely to be living with their parents.”

Huebner also had difficulty finding a job in her field when she graduated, so when she found a job she was working strictly to pay the bills.

“Because I couldn’t find a job in my profession, what I was bringing home at the end of the week nearly all went to paying my student loans,” Huebner said. “In order to have money to spend on gas, groceries and other bills, I had to request lower monthly payments.”

Huebner is worried about her student loans and plans to take it one month at a time. Her plan for the future is to increase how much she pays monthly on her loans with the hope that she’ll have them paid off in as close to 10 years.

Another 2018 Cabrini graduate, Marissa Roberto, has a more positive outlook on paying her student loans.

“I would not say that I am in a deep depression because I have to pay off my student loans,” Roberto said. “I honestly do not find it horrible, and it is not something that I find myself complaining about. Yes, it is a burden to my life, but it is teaching me real-life responsibility and management skills.”

Roberto says that budgeting her expenses is the only way she knows she will be able to pay off her loans in a reasonable amount of time. She plans to pay off her student loans in less than five years from graduating college.

“Year one has passed and I have taken off a good sum from the remaining total,” Roberto said. “I do not want to be stuck with an astronomical price tag of student debt over my head, so the more that I can pay off in a monthly time period means the faster I can get the whole thing done and over with.”

Paying back

The average time it takes graduates to repay their loans is 10 years. But in reality, it takes graduates much longer. According to Best Value Schools, “After graduation, students can choose from several options, with the most common re-payment schedule ending after 180 to 218 months, or 15 to just over 18 years. Some loan re-payment options can be spread to as much as 25 years, however.”

“It is by no means holding me back from living my life the way I want to, but I have become a lot more cost-conscious these days and have been attempting to stick to a monthly budget,” Roberto said.

Both Huebner and Roberto are paying off their student loans on their own. Roberto said that when she received her first statement, her parents offered to pay it for her. Since then, no one has helped her.

According to a survey by College Ave Student Loans, one-third of parents say that they will help their child pay back some or all of their student loans. Still, more than 44.2 million Americans owe $1.5 trillion and the average student loan debt for graduates in 2018 is $33,654.

“Being able to pay off my loans on my own means a lot to me because it is an example of independence and responsibility that helps me prove to myself that I can get some of this ‘adulting’ thing down,” Huebner said. “My parents have offered to help me a few times since then, but I have declined and have just taken their advice to budget wisely.”