Month after month, students all over the country continue to meet the criteria of a “broke college student,” ramen noodle diet and all. All too often young adults find their bank accounts empty and continually struggle to come up with adequate ways to finance their lifestyles.

Eventually, questions start to arise. Students start to worry about credit card bills, loans and how they are ever going to be able to afford a life on their own. Luckily, colleges and universities all over the country are starting to realize that their students need real world knowledge beyond normal courses taught in a typical classroom.

On Wednesday, Oct. 21, a course known as “Money Matters” took Cabrini College by storm. This class is a one-credit course designed to educate young adults on the value of saving as well as to answer the questions that weigh heavy on their minds.

“Money Matters gives students the opportunity to focus on the budgeting process and be thoughtful in terms of savings,” financial aid director, Betsy Gingerich, said.

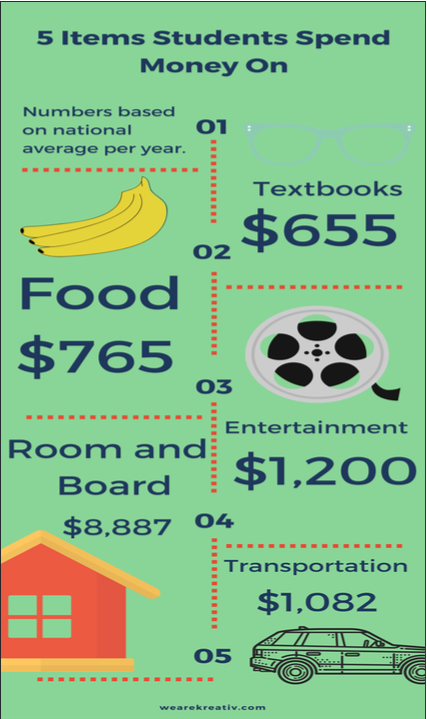

Saving money can be difficult in college, especially when students cannot work full time because of heavy course work. Many find it tough to live on a budget, especially when items such as textbooks, food and cell phone bills come into play.

“If you can’t manage $100 you won’t be able to manage $1,000,” director of enrollment retention, Nakia Mack, said. “It’s a technique that is important for the rest of your life.”

Last year, the class of 2015 became the most indebted class ever nationally with a student loan average of $35,000. This number has doubled the amount that borrowers had to pay back two decades ago according to The Wall Street Journal.

Statistics such as these are causing students to get serious fast about coming up with a plan to pay off the debt that seems to be clouding their hopes of a care-free future.

“Money matters has taught me practical tips and strategies I can use before I graduate to get a head start on building up credit and combating my student loans,” sophomore exercise science major, Sarah Minnick, said.

According to recent studies performed by the Washington Post, 51 percent of college freshman underestimated their debt loans by 10 percent. These numbers are proof that students need guidance and strategies on various ways to manage their money.

“My job is to help Cabrini students with financial aid so that they can focus on what matters. Being a college student can be tough. I want to help them navigate so that they don’t have to worry,” Gingerich said.

Currently, Money Matters is a 12-student class that follows a part lecture, part discussion curriculum. Over the course of the semester students are assigned two projects that focus on interest rates, researching their loan balances as well as creating an actual budget that would correspond with the salary of their future career.

The course will be taught again next semester and will continue to educate students on the importance of financial planning, budgeting, credit card use, investments and more, because “money matters.”