Editor’s Note: The name of the subject in this article has been modified to protect her identity. This is due to the fear of embarrassment that could occur after the article is published. Additionally,she has not released the extent of her debt to her family.

All of Sophie’s hard-work has led to this moment. The opportunity to be the first in her family to attend college. She hopes this will give her the opportunity to work somewhere other than at her family’s florist in central Florida.

She has packed the things that she anticipates she will need for the first semester and packs up the family SUV for the hour and a half drive to campus. After her mother drops her off on campus, Sophie sits on her bed and takes a moment to dream of the opportunities attending college will give her. It isn’t until four years of hard-work later that Sophie realizes she is thousands of dollars into debt and does not yet have a job using her degree obtained from the University.

“I have so much debt that I am fearful to even tell my mother the exact amount,” Sophie said.

In America, over $1.5 trillion dollars is owed in student debt. On average a student accumulates approximately $37,172 in student debt.

To put this into perspective, that amount is approximately a 20 percent down-payment on a $185,000 home, a brand new Tesla, a swimming pool or the price of a nice wedding.

For people like Sophie, it is frustrating when all of the commitment and work seemingly adds up to a disappointment. According to a recent study from Corner Stone University, Sophie is not alone.

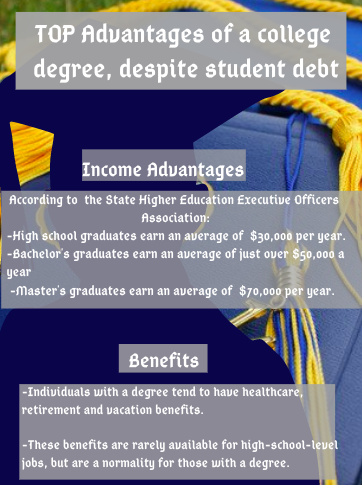

Despite these graduate students frustrations, Georgetown University found that college graduates are predicted to earn $1 million more in their lifetime than that of individuals who have a high school degree only.

Additionally, Pew Research Center estimates the yearly income gap between those with high school degree and those with bachelor degrees to be approximately $17,500. The true cost of not going to college is never seeing that extra $17,500 per year and estimated extra $1 million per lifetime.

Despite the heaping pounds of debt accumulated fresh out of college, it is important to remember the advantages of obtaining a college degree.

David Bloomfield is the professor of education leadership at Brooklyn College. He believes that earning a bachelor’s degree is the wisest investment an individual can make.

“Completed degree programs from reputable institutions are still the most reliable investment in future income and well-being,” Bloomfield says.

Jeffrey Dorfman is a writer for Forbes.com. Additionally, Dorfman is a professor of economics at The University of Georgia. Dorfman believes that in having a degree, your earnings are higher and you have a very low probability of being consistently unemployed.

“While the cliché of Ivy League college graduates working at Starbucks making coffee makes a great story, it is actually pretty rare,” Dorfman said. “Stories of under-and unemployed college graduates may sell well, but they are mostly myths…file them under the heading of fake news.”