Students are burdened with more loan debt now that in recent decades according to a recent study.

Students may look at college as a way to increase income and learn skills needed for desired careers, but the Director of Financial Aid and the rest of the Cabrini administration work hard to ensure that students do not leave with too much debt.

“I do think from what I’m hearing and seeing that schools have increased tuition and fees and it’s simply more expensive to go to college,” Betsy Gingerich, director of financial aid, said.

A 2012 study done by Harvard University and the University of Virginia found that college increases the average earnings by age 64 from $780,000 to $1.2 million today. This increased earning is approximately $400,000 differences whereas the gap between those who went to college in 1965-85 was closer to $200,000.

As far as loans go, the report found that in the last 20 years, more undergraduates have been going into debt to further their education moving from 19 percent between 1989-1990 and 35 percent from 2007-2008. Reasons for the change include the fact that the U.S. government used to provide more grants than loans, and as loans increased 2009 led to a major drop in the amount of grants.

“Federal and state financial aid have not kept pace with the cost of college and because of those factors competing against each other students have had to borrow more in order to go to college,” Gingerich said.

Current junior secondary education major Frances McPeak decided this semester to stop living on campus for the first time since coming to Cabrini in fall 2012.

“I have decided to live at home for the last year and half of college so I can save more than 50,000 dollars so I can be less in debt,” McPeak said. “I also know that I will be living with my parents for a year or two after I graduate so I can save money and eventually live on my own as I pay my debt.”

Another trend that has occurred over the last few decades is private borrowing. Harvard University and the University of Virginia found that between 1995-1996 the United States had about $1.5 billion in private loans from students, but between 2007-2008 that number multiplied to $21.8 billion.

“The area that does concern me in terms of student indebtedness is the private alternative borrowing,” Gingerich said. “These are students who you hear are really struggling and they have high indebtedness when they graduate from the college because students can borrow higher amounts from these [private] sources.”

Although Gingerich has observed that at Cabrini the amount of private borrowing by students has decreased over the last few years from the efforts by the financial aid office and administration to keep students from having to take out private loans, there is no doubt that students are using private loans to pay for their education.

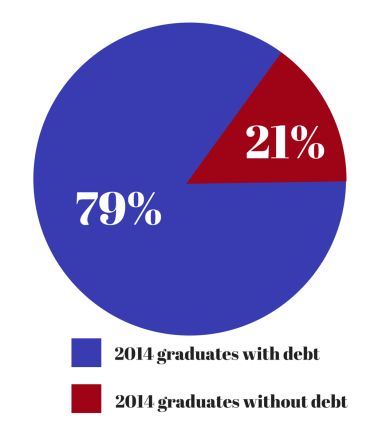

The limits to federal loans help students to avoid trouble with paying loans after graduation. According to Gingerich, the average Cabrini student graduates with $27,000 in federal debt. Out of the 233 undergraduates who graduated last year, 175 of them had debt and 48 were able to leave college with no debt.

“Typically a student could expect a 10-year repayment plan that would be about $310 per month for that loan,” Gingerich said. “The data will tell you that a student that’s making at least $35,000 after they graduate from college can handle that type of loan with their other expenses.”

As the administration has noticed more and more students handling their own finances compared to students in the past, more programs have been created to teach students how to handle their finances.

“I think in terms of financial literacy efforts here at the college with the financial aid office and also with our director we work very hard to get in front of students and to educate them about their loans, about financial aid, about what’s available and it’s really really important.” Gingerich said. “The more that students know and the more they understand they can take control of their borrowing instead of being surprised at graduation how much they owe.”

Even though there are resources available through Cabrini’s website and the financial aid office to help students, paying off loans still can be a daunting task that follows students after college.

“I will be paying student loan debt back for a long time unless some miracle happens that allows me not to have to pay it back,” McPeak said.