College students have optimism for success after graduation along with an underlying fear of being in massive debt. With the economy and fearful job market being at a low, student loans are a constant battle students struggle with. An income-based repayment program called “Pay as You Earn,” is geared to control the size of the repayments based on how much income one makes.

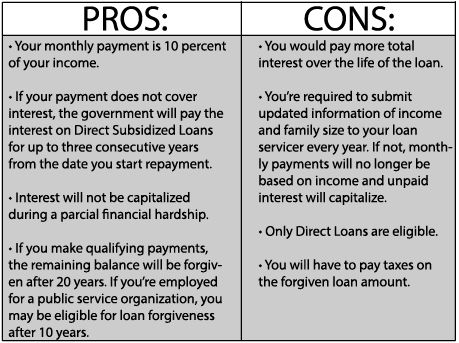

The United States Department of Education established the Obama administration’s improved plan to make it easier for students, lowering the cost of loan payments with the basis of 10 percent of the borrowers discretionary income. This will also allow loans to be forgiven after 20 years of payments.

“We know many recent graduates are worried about repaying their student loans as our economy continues to recover, and now it’s easier than ever for student borrowers to lower monthly payments and stay on track,” said U.S. Secretary of Education Arne Duncan, on the U.S Department of Education’s website.

This plan is an option for ensuring recent graduates they can manage their finances and debt, with this relief of lower monthly payments. This program is not for everyone and not all loans fit this program. This plan is best used to those who are not meeting the full payments due to their high debt not matching their set income.